nj property tax relief for veterans

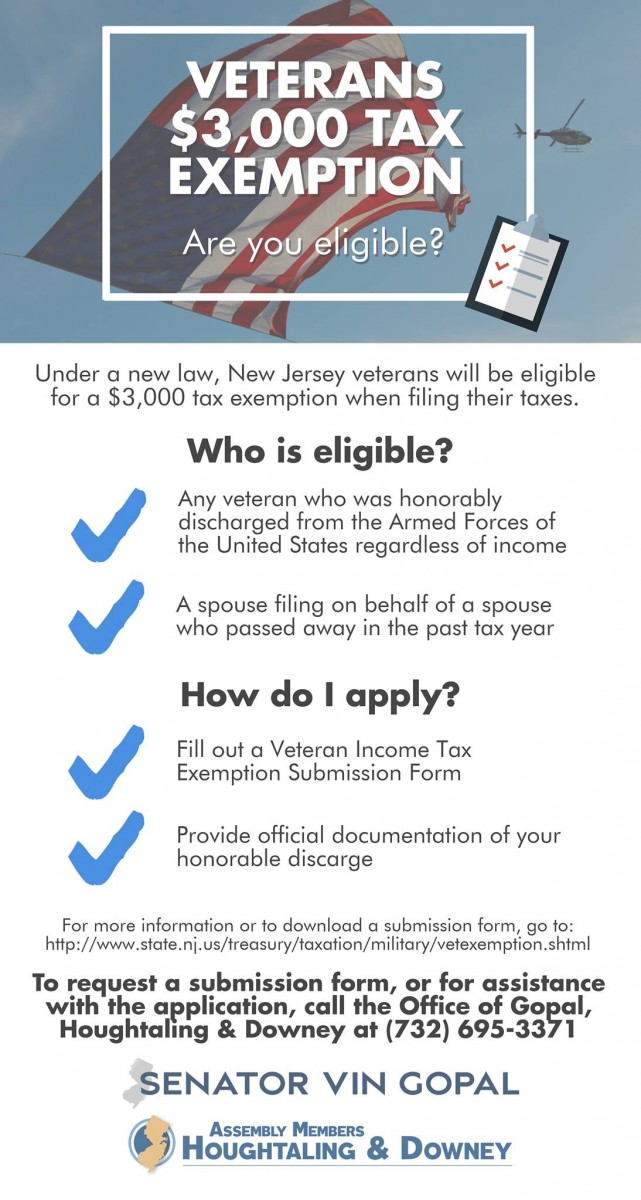

To qualify for this exemption you need to. Military Personnel Veterans New for 2021 - Income Tax.

Commissioners Support Legislation To Increase Property Tax Deduction For Veterans

It was founded in 2000 and has since become a member of.

. The state also offers a homestead tax credit and property tax relief for active military personnel. TRENTON NJ New Jerseys fully disabled veterans may soon have a retroactive property tax exemption dating back to the date of their disability determination by the Veterans. Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior.

Covid19njgov Call NJPIES Call Center for medical information related to COVID. If you have questions call your local assessor or call the Division of Taxation at 609-292-7974. Military and Veteran Tax Benefits New for 2021 - Income Tax.

Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their. At least 14 days in a combat zone are eligible for an annual 250 property tax deduction. If you have questions call your local assessor or tax collector or call the Division of Taxation at 609-292-7974.

About the Company Nj Property Tax Relief For Veterans. The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. If you need help documenting your veteran status call.

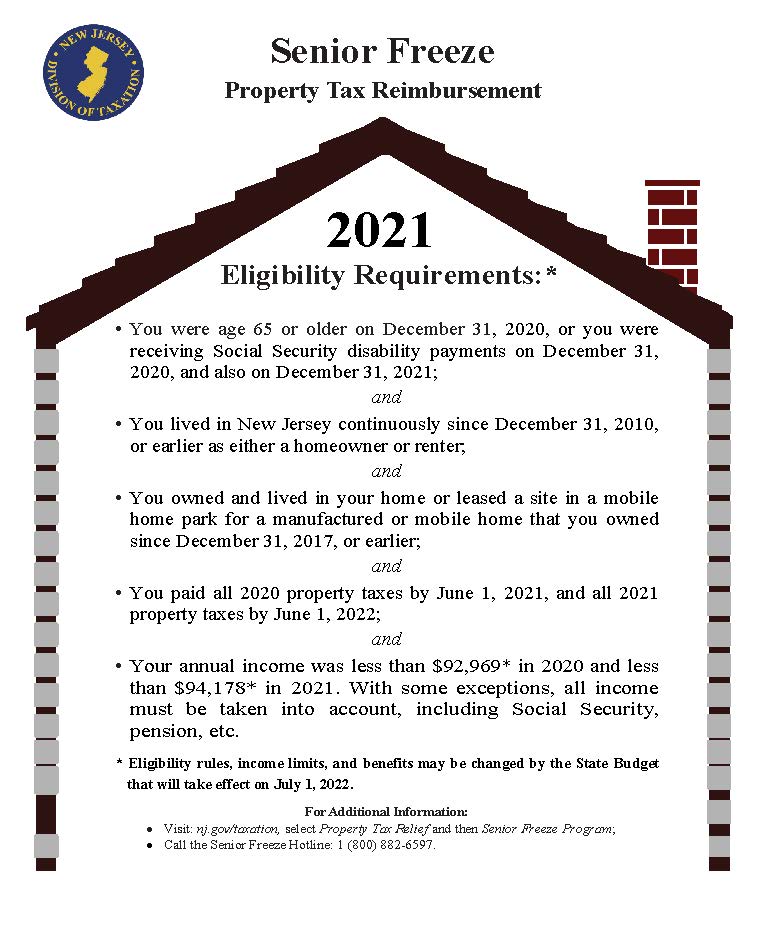

If you have questions call your local assessor or tax collector or call the Division of Taxation at 609-292-7974. Be 65 or older. COVID-19 is still active.

Property Tax Relief Forms. Local Property Tax Forms. New Jersey Department of.

If you need help documenting your veteran status call. Applications for the homeowner benefit are not available on this site for printing. If you have questions call your local assessor or call the Division of Taxation at 609-292-7974.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption. CuraDebt is a company that provides debt relief from Hollywood Florida.

The state of New Jersey provides several veteran benefits. New Jerseys Property Tax Relief Programs. By Mail - send a copy of your documentation and Veteran Income Tax Exemption Submission Form to.

More veterans can get help with property taxes. The New Jersey Division of Taxation Veteran Exemption PO Box 440. It was founded in 2000 and is a member of the American Fair Credit.

Stay up to date on vaccine information. A disabled veteran in New Jersey may receive a full property tax exemption on hisher. There is no specific property tax break for veterans in New Jersey but they may be eligible for certain exemptions that can lower their overall tax bill.

CuraDebt is a debt relief company from Hollywood Florida. For example veterans with a. If you need help documenting your veteran status call.

NJ offers a property tax exemption for senior citizens disabled persons and their surviving spouses. Civil Union Act Implementation. If you need help documenting your veteran status call.

About the Company Property Tax Relief For Veterans In Nj. Local Property Tax Relief Programs. Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior.

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

Connors Rumpf Gove S Disabled Veteran Property Tax Relief Measure Passes Senate Senatenj Com

Tax Assessment And Collection News Announcements West Amwell Nj

Veterans Benefits 2020 Most Underused State Benefit Va News

Veteran Services Passaic County Nj

N J Challenge To Reduced Property Tax Breaks Under Trump Tax Law Turned Away By Supreme Court Nj Com

Tax Break For Disabled Vets Who Own Coops Nj Spotlight News

Nj Voters Expand Property Tax Help For Veterans Here S How To Apply

Hunterdon County Officials Unveil You Earned It Campaign For Veterans Property Tax Deduction Wrnj Radio

Nj Division Of Taxation 2018 Income Tax Changes

Gopal Resolution To Extend Eligibility For Veterans Property Tax Deduction And Exemption In Continuing Care Retirement Communities Advances Nj Senate Democrats

Union County Office Of Veterans Services County Of Union

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

New Jersey Military And Veterans Benefits The Official Army Benefits Website

All New Jersey Veteran Homeowners Now Qualify For The 250 Deduction West Amwell Nj